Financial life planning covers a wide array of topics from daily decisions regarding money, to setting your child up for a secure future, to retirement and estate planning. While looking at the long term is critical, some people lose track of the important day-to-day pieces that are essential to financial security.

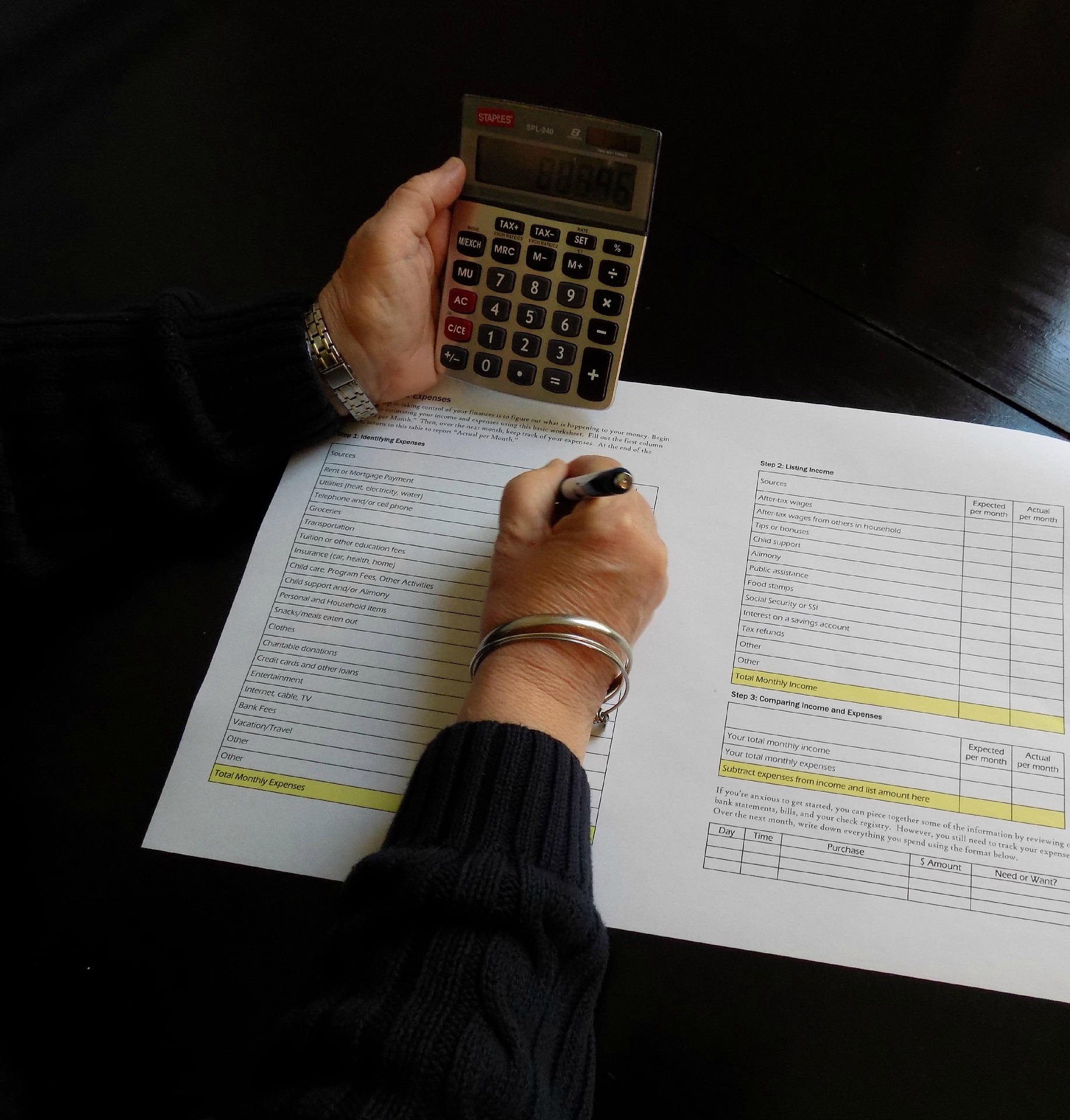

Following a monthly budget is essential to long-term financial security

The Business Insider reveals that many people don’t use a monthly budget and a large percentage of Americans regularly carry credit card debt. In terms of financial health and life planning, changing these habits can have a significant impact on your family’s long-term financial security. Budgets can feel cumbersome to set up initially, but they can be key for staying on track with spending and keeping you aware of frivolous expenditures.

Life is busy and chaotic for most people these days, and sometimes financial basics fall to the wayside. It can be easy to lose track of how much money you have in your wallet or even a safe at home, or even lose track of a check or two in your checkbook. However, when you are trying to carefully track your spending habits and plan your family’s financial future, every dollar and detail counts.

Track your spending and cut out unnecessary purchases

Better Money Habits suggests relying on the basics to keep your spending in check. Many experts recommend relying on cash for purchases rather than credit cards or even debit cards, and if you do use credit, strive to pay those bills off immediately. When you are heading out to shop, especially for groceries, use a detailed list so you avoid impulse buys and can stick to your budget.

Tracking your spending and sticking to a budget will help you keep track of where your money is going. In addition, it will show you where you can cut back or start saving to secure your family’s future. It will also help you stay alert when it comes to fraud issues.

Be aware of fraud issues and report issues immediately

Fraud has become a concern for many people these days. CNN details that it is essential to closely track your bank account and credit card activity to watch for unexpected expenditures. If you notice something that seems off, contact your bank or card holder immediately to put a stop to unauthorized spending.

Whether you decide to use financial software on your computer, a simple written spreadsheet, or an app you can use on your smartphone, Investopedia recommends looking at your budget at least monthly so you can make adjustments as needed. Create a plan for keeping bills organized and make sure you are watching for ones that may fall through the cracks with a missed statement in the mail or similar glitch.

Kristie Sawicki of Saving Dollars and Sense shared via AOL that it is wise to review your spending every week or month to see where you can eliminate unnecessary expenditures. Don’t be afraid to negotiate rates or packages with credit card, cell phone, or cable companies and be vigilant in taking the money you save and using it to pay off debt or save for your future.

Saving for the future can feel like an abstract process, but the money decisions you make daily can have a significant impact on your financial stability down the road. The sooner you take charge of your daily spending, the more you will be able to start saving for retirement or a child’s college education. By budgeting and paying close attention to your daily spending, you are setting the stage for greater financial security for your family down the road.

[Image via Pixabay]